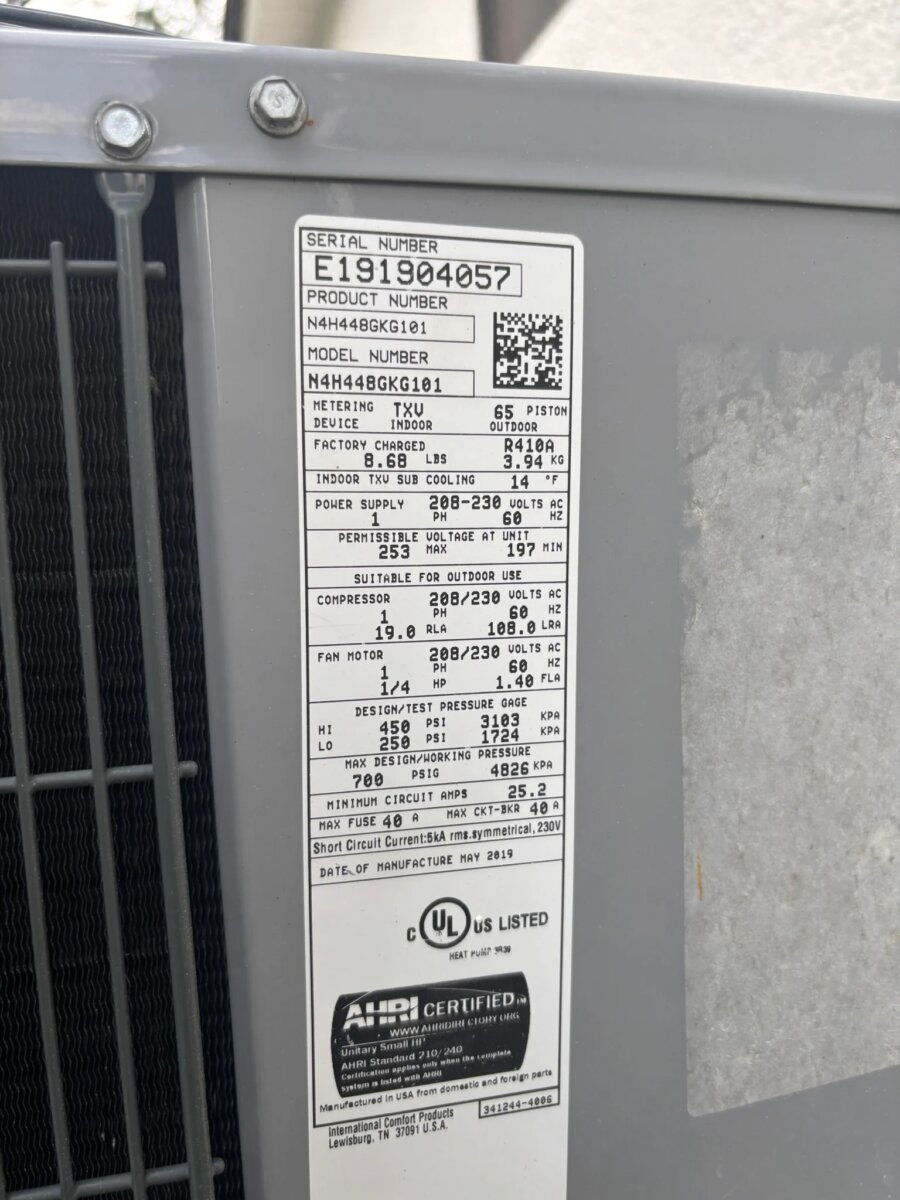

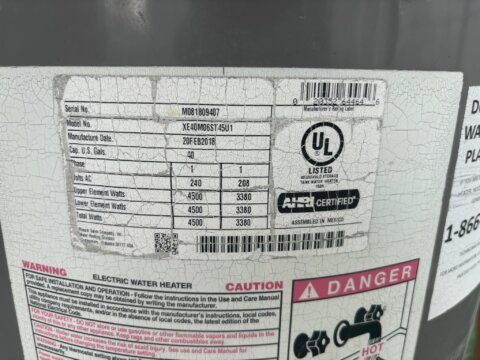

This 1,848–2,000 sq ft 6-bed, 5-bath home sits on a 5,100 sq ft lot in the heart of Tampa, just 5 minutes from Raymond James Stadium and 15 minutes from Tampa International Airport. Built in 1947, the home features a block & frame structure, a newish roof (2015), AC (2019), and water heater (2018). The property is currently configured as a multi-room rental (padsplit-style) with private baths and some private entrances. There is a permitted 1/1 ADU, and the layout offers flexibility to convert the property into a traditional 5/4 single-family home with income-producing potential. No HOA. Property is zoned RS-50.

🛠️ Light Cosmetic – Room-by-Room Setup, Flexibility for Value-Add

The property functions well for investors seeking rental income, with most rooms rented individually, but there is plenty of room for a flip as well. Cosmetic updating is recommended to modernize finishes, improve curb appeal, or convert layout to appeal to a broader buyer pool. All systems are reported functional.

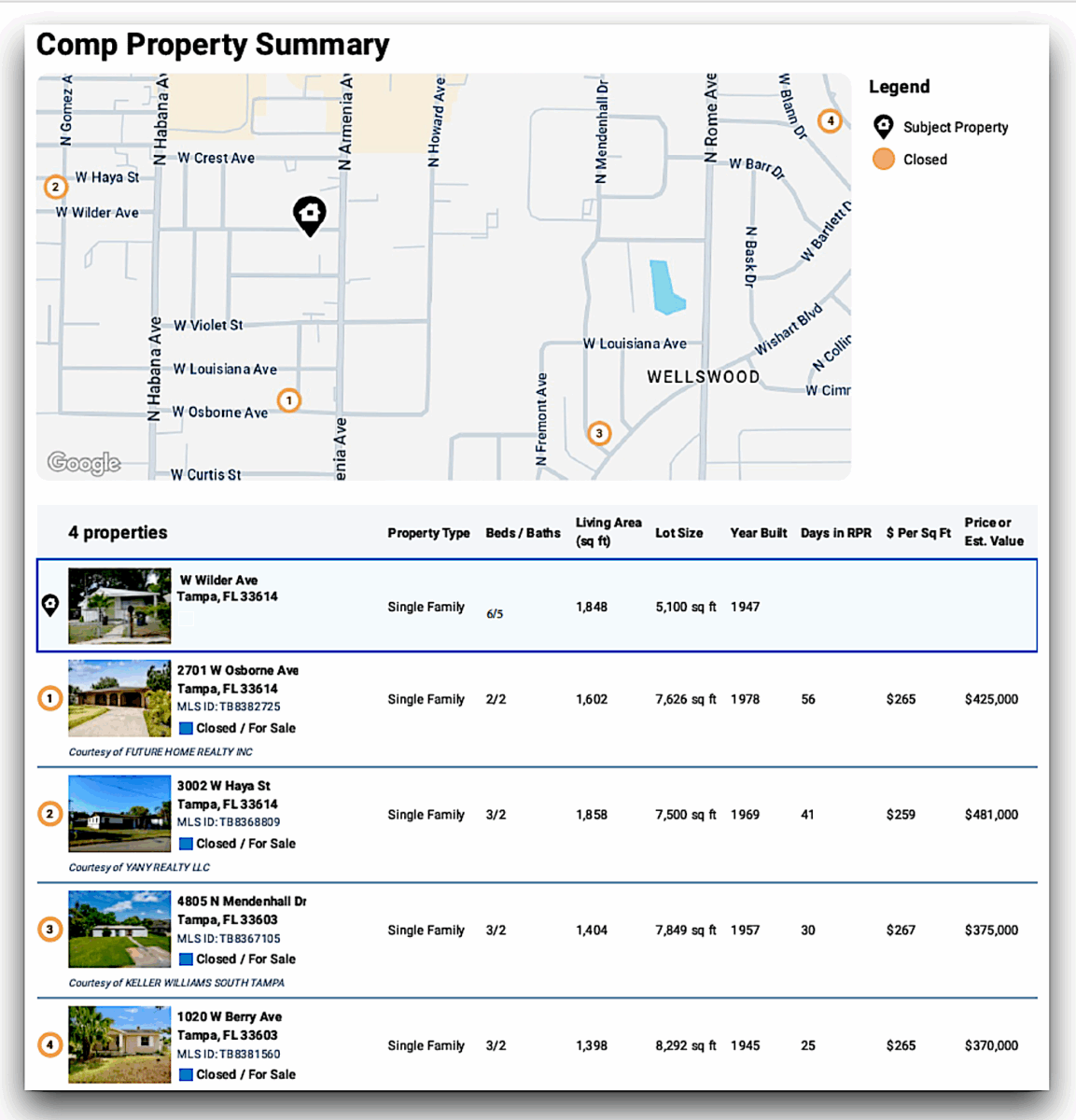

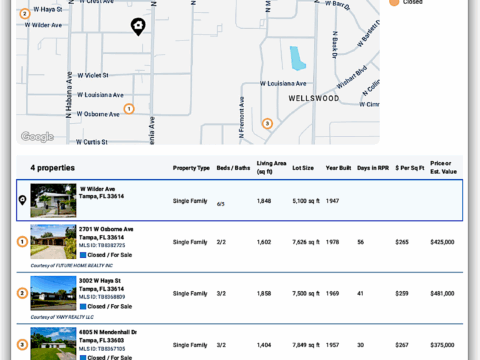

🔴 Recently Sold (Comps)

· 2701 W Osborne Ave – 1,602 sq ft, 2/2, built 1978 → Sold $425,000 ($265/sq ft) – clean condition

· 3002 W Haya St – 1,858 sq ft, 3/2, built 1969 → Sold $481,000 ($259/sq ft) – slightly larger, updated

· 4805 N Mendendall Dr – 1,404 sq ft, 3/2, built 1957 → Sold $375,000 ($267/sq ft) – smaller, updated

· 1020 W Berry Ave – 1,398 sq ft, 3/2, built 1945 → Sold $370,000 ($265/sq ft) – smaller, similar age

🟠 Income Snapshot

· Back unit – $750

· Two middle units – $550 & $750

· Front left unit – $1,200

· Main house (2/1) – currently vacant but interest is confirmed

· Total current rent (occupied units): ~$3,250/mo

· Potential full rent (with main house leased): ~$4,000–$4,500/mo

✅ ARV Conclusion

Based on the recent comps and existing setup:

- Low-end ARV: ~$425,000 (if sold as-is with tenant leases in place)

- Likely ARV: $450,000–$475,000 (if cosmetically improved or restructured as SFR/ADU combo)

- High-end ARV: $500,000+ (if fully modernized and marketed to owner-occupants or savvy investors)

At a potential price under current market highs, this is a solid cash-flowing rental or light value-add flip opportunity in a prime central Tampa location, with flexibility depending on investor strategy.